The Real Estate (Regulation and Development) Act, 2016 (RERA) has established several requirements for developers, promoters, and other stakeholders in the real estate sector to ensure transparency and accountability. One such requirement is the annual audit, which is critical for maintaining the financial integrity of RERA-registered projects. In this blog, we explore the annual audit requirement under RERA, its significance, and how developers can comply with this crucial provision.

What is the Annual Audit Requirement Under RERA?

As per Section 4 of RERA, developers and promoters are required to have their financials audited annually. The purpose of this audit is to ensure that the funds collected for a project are being used for their intended purpose and to verify the accuracy of financial statements related to the project.

The annual audit must be conducted by a Chartered Accountant (CA) (preferably by the Statutory Auditor of the Promoter, as required by most of the State RERAs). The auditor will review the project's financial records, including income, expenses, and funds collected from homebuyers or investors.

Who is Responsible for the Annual Audit?

The promoter or developer is responsible for ensuring that the audit is conducted. As per RERA, the developer is required to submit the audited financial statements to the concerned RERA authority on an annual basis, along with the necessary supporting documents.

The auditor must provide an audit certificate/report in the prescribed format, which affirms that the project's financial statements reflect true and accurate records, and that the project is compliant with RERA’s financial management rules.

What Does the Annual Audit Include?

The audit covers various aspects of the project, including:

Verification of Funds: Ensuring that the funds collected from homebuyers or investors are being used solely for the construction and development of the registered project.

Assessment of Project Expenses: Examining project expenses, including the cost of construction, payments to contractors, and any other expenses related to the project.

Financial Statements Review: The audit reviews the developer’s financial statements, balance sheets, income statements, and cash flow to verify the accuracy and compliance with RERA regulations.

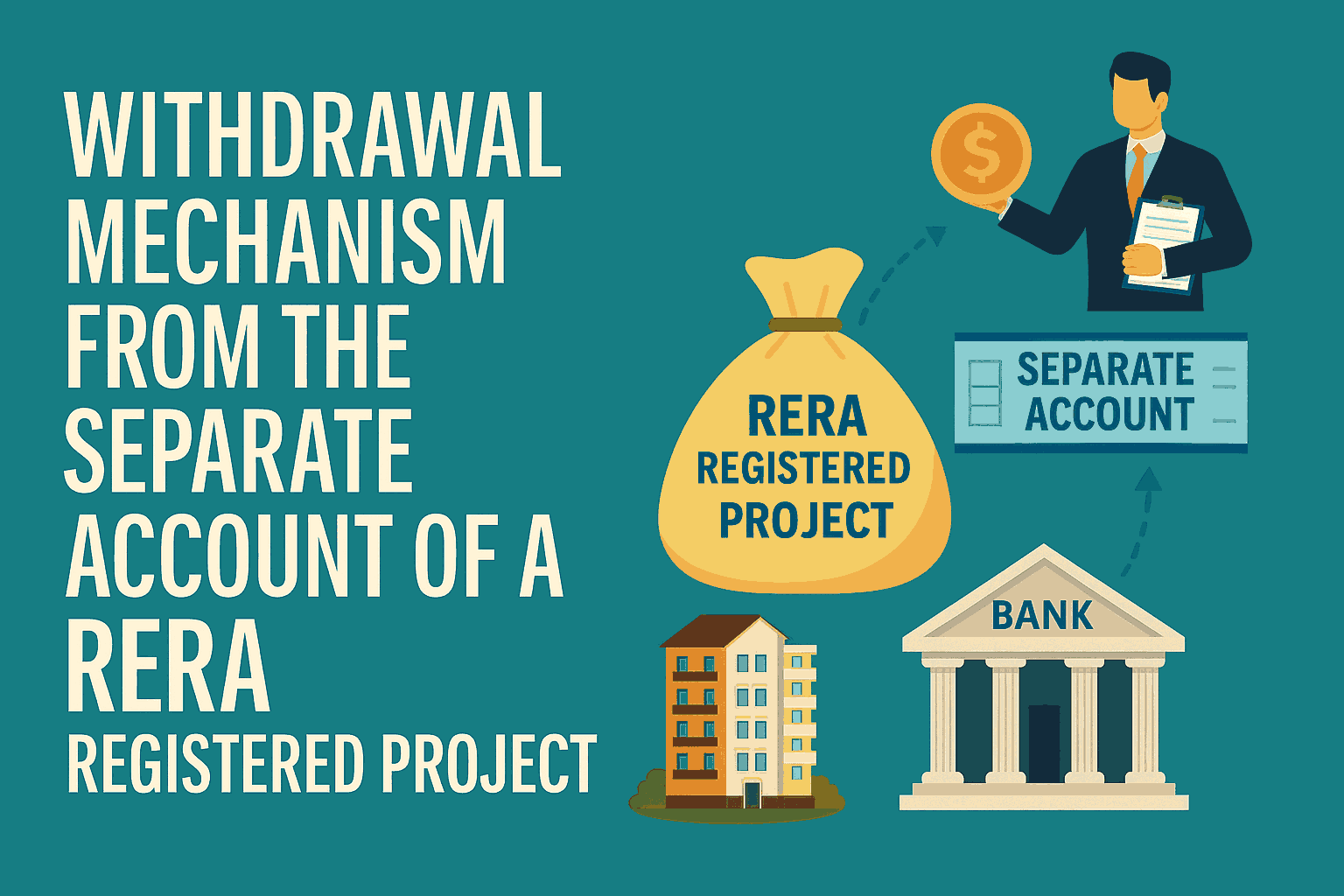

Separate Account Review: Under RERA, developers are required to maintain a Separate Account for each registered project. The auditor will ensure that the funds in this account are appropriately allocated and used solely for the purpose of completing the registered project.

Why is the Annual Audit Important?

Transparency: The annual audit ensures transparency in the handling of funds. Homebuyers and investors have peace of mind knowing that the funds are being managed appropriately and used for the project’s development.

Compliance: Developers are required by law to comply with RERA regulations, including the annual audit. Failure to do so may result in penalties, suspension of registration, or legal action.

Financial Integrity: The audit ensures that there is no financial mismanagement or misallocation of funds. This adds to the credibility of the developer and helps maintain their reputation in the market.

Protection for Homebuyers: By requiring developers to submit an audited financial report, RERA protects the interests of homebuyers, ensuring that the money they invest is used responsibly and that projects are completed as promised.

What Happens if the Annual Audit is Not Conducted?

Penalties for Non-Compliance: Developers who fail to submit the annual audit report within the prescribed timeline can face penalties under RERA. This can include fines or even cancellation of the project registration.

Project Delays and Lapsed Registration: If a developer does not comply with the audit requirement, the project’s registration may lapse, and the developer may lose the right to advertise or sell units in the project under RERA.

How to Comply with the Annual Audit Requirement?

Developers must ensure that their financial records are maintained in a transparent and accurate manner. They should work with a registered Chartered Accountant who is familiar with RERA’s requirements.

It is advisable to prepare the necessary documentation well in advance of the audit deadline, as this will allow for a smoother process and avoid delays.

Once the audit is completed, the developer must submit the audit certificate to the RERA authority along with any additional documentation required by the authority.

The annual audit requirement under RERA plays a vital role in ensuring financial transparency, accountability, and compliance within the real estate sector. For developers, it is an essential part of maintaining project registration and gaining the trust of homebuyers and investors. RERA’s strict audit provisions protect the interests of all stakeholders involved in real estate projects and foster a more transparent and reliable real estate market. Apex RERA Professionals offers expert assistance in navigating RERA’s audit requirements, ensuring developers comply with the necessary regulations while maintaining financial integrity.

Author

CA Akash Jaiswal

Chief Advisor, Apex RERA Professionals

Contact

Apex RERA Professionals is owned by Realtyedge Professionals LLP.