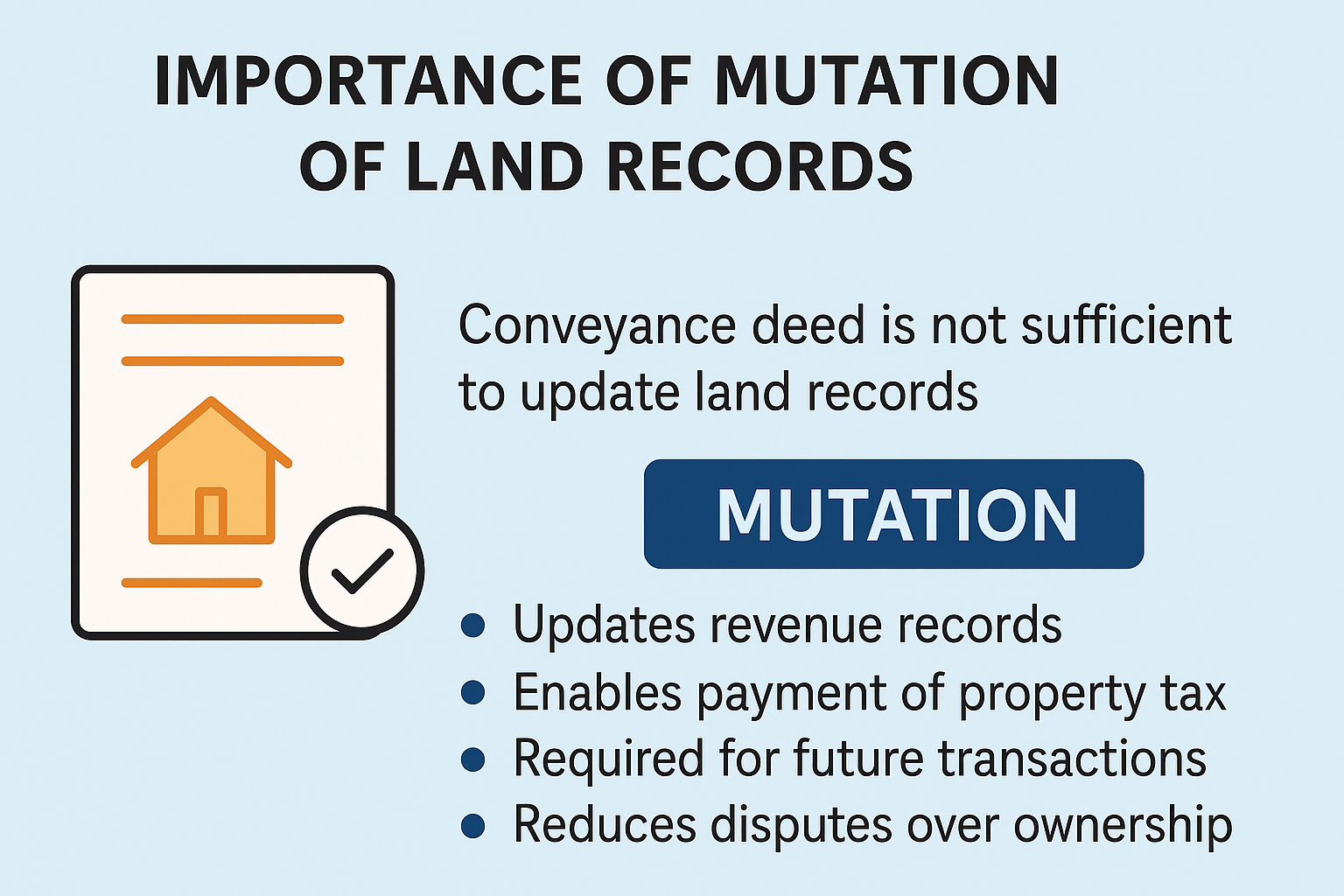

When it comes to land or property ownership in India, most people believe that a registered sale deed or conveyance deed is all they need to prove ownership. But here’s the reality:

➡️ A registered deed shows the transaction.

➡️ But mutation reflects ownership in the eyes of the government.

This is where the process of Mutation of Land Records becomes critical — yet it's one of the most misunderstood aspects of land transactions.

What is Mutation?

Mutation is the process of updating the land revenue records maintained by the local municipal or revenue authority after a property is transferred.

Once the mutation is completed, the new owner’s name is reflected in the land records (like Khatauni, Khata, or Property Register), allowing them to pay property taxes in their own name.

Why the Sale Deed Alone is Not Enough

Many property buyers assume that a registered conveyance or sale deed is the final step. But unless mutation is completed, the following risks arise:

Benefits of Mutation

When is Mutation Required?

Mutation is essential in the following cases:

How to Apply for Mutation?

Although the process may vary by state, the typical steps include:

In many states like Uttar Pradesh, mutation is now also facilitated through online portals for better transparency and tracking.

Mutation ≠ Title Proof

It’s important to note that mutation does not confer ownership title. It is a record of possession for tax and administrative purposes, while the registered deed remains the legal proof of ownership. However, in practice, mutation is often treated as strong presumptive evidence of ownership by revenue and municipal authorities.

Contact

Apex RERA Professionals is owned by Realtyedge Professionals LLP.